Corporate Governance

- Our Corporate Governance Policy

- Corporate Governance Structure

- Outside Directors and Corporate Auditors

- Skills Matrix of Director and Corporate Auditor

- Analysis and Evaluation of the Effectiveness of the Board of Directors

- Policy on Deciding Directors’ and Corporate Auditors’ Remuneration

- Cross-shareholdings Policy

Our Corporate Governance Policy

We believe that to increase corporate value and achieve sustained growth, it is essential to continue to ensure managerial transparency and strengthen supervisory functions regarding the execution of business affairs. This is our basic policy on corporate governance and we will strive to improve our organization and business systems in accordance with this policy.

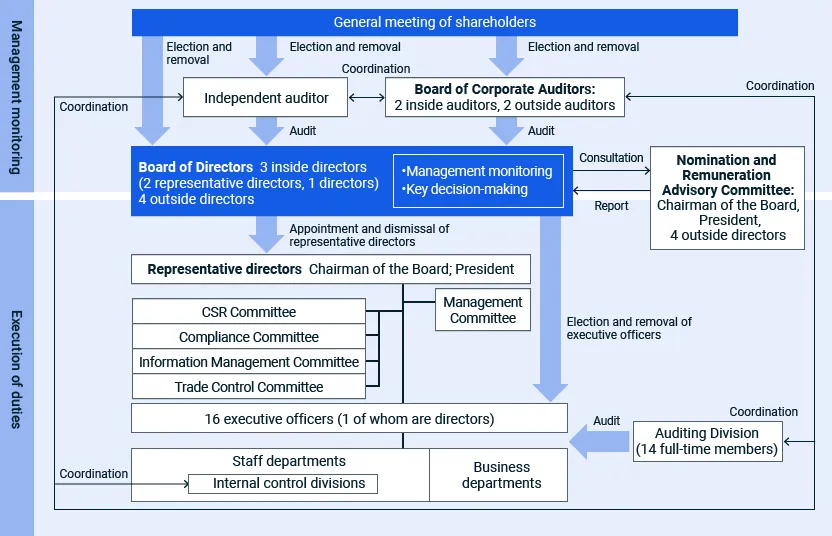

Corporate Governance Structure

NEG is a company with a board of corporate auditors. The Board of Directors, which includes outside directors, carries out decision-making regarding the execution of duties and supervision of the execution of duties by directors and others. The supervision of the directors is carried out independently of the Board of Directors and the executive structure by the Board of Corporate Auditors, which includes outside corporate auditors. This system is intended to ensure the transparency and fairness of the Board of Directors.

Also, a Nomination and Remuneration Advisory Committee, which exists as a voluntary committee, has been established as an advisory body to the Board of Directors. The committee deliberates on the appropriateness of matters related to the appointment and dismissal of representative directors, remuneration policies and systems for directors, and the amount of remuneration determined for directors. It then reports its conclusions to the Board of Directors.

In addition, the CSR Committee, the Compliance Committee, the Information Management Committee, and the Trade Control Committee facilitate organization-wide initiatives to strengthen corporate governance.

| 2000s | 2010s | 2020s | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Settlement and shares | 2006 Takeover defense measures introduced |

2012 Takeover defense measures abolished |

||||||||||||||||||||||||

| Business execution supervision system |

2001 Executive officer system introduced Start of reduction in the number of directors |

2015 First independent outside director appointed |

2020 Nomination and Remuneration Advisory Committee established |

|||||||||||||||||||||||

| 2003 Term of office for directors shortened to one year First independent outside corporate auditor appointed |

2016 Independent outside directors increased to two Start of evaluation of Board of Directors effectiveness |

2023 Non-Japanese executive officer appointed Corporate advisor system abolished |

||||||||||||||||||||||||

| 2019 In total, three independent outside directors appointed (outside directors now comprise one-third) System for granting restricted shares introduced First female outside director appointed |

2025 Independent outside directors made a majority of the Board of Directors |

|||||||||||||||||||||||||

| Internal control and risk management | 2000 Principles of Activities established |

2015 Corporate Philosophy Structure established Business continuity planning formulated |

2023 CSR Committee established |

|||||||||||||||||||||||

| 2003 Auditing Division established |

2019 Whistleblowing system introduced for all group companies |

|||||||||||||||||||||||||

| 2006 NEG Hotline whistleblowing system introduced Compliance Committee established |

||||||||||||||||||||||||||

| Position | Name | Board of Directors meetings | Board of Corporate Auditors meetings | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| President | Motoharu Matsumoto | 14/14 meetings (100%) | ― | |||||||||||||||||||||||

| Akira Kishimoto | 14/14 meetings (100%) | ― | ||||||||||||||||||||||||

| Directors | Hiroki Yamazaki | 14/14 meetings (100%) | ― | |||||||||||||||||||||||

| Tomonori Kano | 14/14 meetings (100%) | ― | ||||||||||||||||||||||||

| Mamoru Morii | 14/14 meetings (100%) | ― | ||||||||||||||||||||||||

| Outside directors | Reiko Urade | 14/14 meetings (100%) | ― | |||||||||||||||||||||||

| Hiroyuki Ito | 14/14 meetings (100%) | ― | ||||||||||||||||||||||||

| Yoshio Ito | 14/14 meetings (100%) | ― | ||||||||||||||||||||||||

| Nahomi Aoto | 11/11 meetings (100%) (since being appointed in March 2024) |

― | ||||||||||||||||||||||||

| Full-time corporate auditors | Masahiko Ohji | 14/14 meetings (100%) | 13/13 meetings (100%) | |||||||||||||||||||||||

| Yoshihisa Hayashi | 14/14 meetings (100%) | 13/13 meetings (100%) | ||||||||||||||||||||||||

| Outside corporate auditors | Yukihiro Yagura | 14/14 meetings (100%) | 13/13 meetings (100%) | |||||||||||||||||||||||

| Hiroji Indoh | 14/14 meetings (100%) | 13/13 meetings (100%) | ||||||||||||||||||||||||

Outside Directors and Corporate Auditors

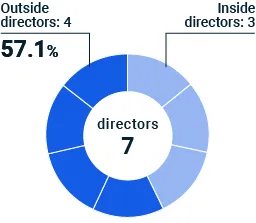

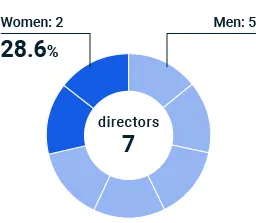

As of March 28, 2025, there are four outside directors and two outside corporate auditors within the company. Outside directors make up a majority of the Board of Directors, which includes two female outside directors.

In order to strengthen the management supervisory capabilities of the Board of Directors and other corporate administrative bodies by ensuring that they receive informed and objective advice, our outside director appointments include; a corporate management expert with many years of first-hand knowledge and experience in the world of corporate management; an economist with expertise and a robust background in corporate governance and organizational management; a science expert who is specialized and highly experienced in the field of agricultural sciences; and a technical expert with extensive experience and expertise in technology development and a proven track record in the technology development department of a global company and involvement in human resource development.

Outside corporate auditors consist of one certified accountant and tax accountant and one attorney at law, who are both independent from the company and are highly knowledgeable and experienced in their respective fields. They proactively perform their auditing duties and reinforce supervisory functions.

We base our determination of the independence of outside officers on the criteria established by the Tokyo Stock Exchange as well as on our own “Independence Standards for Outside Directors and Outside Corporate Auditors” described below. No personal, capital, or business relationship, nor any other interest to which any of above-mentioned criteria apply, exists between NEG’s outside officers and NEG, and, in light of the fact that they fulfill all of the requisite criteria, we have registered all our outside officers as independent directors/auditors with the Tokyo Stock Exchange.

Board of Directors

The Board of Directors makes decisions on important management affairs of the NEG Group and supervises the execution of business affairs. As of March 28, 2025, the Board of Directors consists of seven members (including two representative directors, one inside director, and four outside directors). The Board of Directors is presided over by the Chairman of the Board. To achieve clarity of management responsibility and develop a flexible management system capable of responding to changes in the business environment, the term of directors is set at one year. Regular Board of Directors meetings are held monthly, and extraordinary Board of Directors meetings are held when necessary. In addition, at the budget meeting held once a year, the Board of Directors monitors management by hearing explanations directly from the respective executive officers about the business outcomes of the current fiscal year and the budget of the next fiscal year.

The reasons for appointment for all directors are included in the Notice of the 106th Ordinary General Meeting of Shareholders (held on March 28, 2025) and can be found on the NEG website.

Board of Corporate Auditors

We adopt a corporate auditor system. As of March 28, 2025, the Board of Corporate Auditors consists of four corporate auditors, two of whom are outside corporate auditors. Corporate auditors conduct audits of the directors’ execution of their duties through assessing business affairs and corporate assets and setting important audit issues according to auditing policies, plans, and assignment of duties established by the Board of Corporate Auditors. They also participate in Board of Directors meetings.

Corporate auditors endeavor to improve the effectiveness of their audits by deepening their understanding about the company’s business operations. For this purpose, the corporate auditors take various measures, such as attending the annual budget meeting and periodically questioning directors and executive officers about their duties and handling of business affairs.

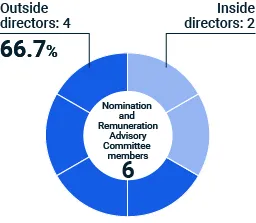

Nomination and Remuneration Advisory Committee

As part of our efforts to strengthen our corporate governance, the company established the Nomination and Remuneration Advisory Committee to ensure transparency and objectivity in the appointment and dismissal of representative directors and in the process of determining director remuneration. The Committee deliberates on the appropriateness of matters related to the appointment and dismissal of representative directors, remuneration policies and systems for directors, and the amount of remuneration determined for directors. It then reports its conclusions to the Board of Directors.

The Nomination and Remuneration Advisory Committee met four times during fiscal 2024. The committee reviewed the director remuneration policy and system, and reported the total amount of director bonuses to the Board of Directors. Evaluation and allocation of the monthly remuneration (fixed) and bonus for each director (excluding outside directors) does not need to be reported to the Board of Directors, and decisions of the Committee are deemed to have the approval of the Board of Directors.

As of March 28, 2025, the Committee comprises two representative directors and four outside directors. Its membership is shown below.

| Chair | Yoshio Ito (outside director) | |||||||||||||||||||||||||

| Members | Motoharu Matsumoto (chairman of the board) | |||||||||||||||||||||||||

| Akira Kishimoto (president) | ||||||||||||||||||||||||||

| Reiko Urade (outside director) | ||||||||||||||||||||||||||

| Hiroyuki Ito (outside director) | ||||||||||||||||||||||||||

| Nahomi Aoto (outside director) | ||||||||||||||||||||||||||

Management Committee

The Management Committee deliberates on the company’s important managerial affairs and draws up detailed action plans regarding the decisions made at the Board of Directors meetings. Management Committee meetings are held twice a month and when deemed necessary.

As of March 28, 2025, the Management Committee comprises three inside directors (two of whom are representative directors) , one executive vice president, and seven senior vice presidents.

Executive Officers

We adopt an executive officer system to promote faster decision making, ensure managerial transparency, and enhance the execution of business affairs. As of March 28, 2025, in addition to the president, there are 16 executive officers (one of whom is a director, one of whom is French). The president is responsible for execution of duties and the other executive officers execute the duties assigned to them by the president. Each executive officer serves for a term of one year.

Skills Matrix of Director and Corporate Auditor

Director and Corporate Auditor Expertise and Backgrounds

For the corporation to be able to respond flexibly to a changing climate and business conditions, and to improve corporate value over the medium and long term, we consider it necessary for directors and corporate auditors to have specialized expertise in a range of areas related to management.

| Name | Position in the company | Outside independent | Gender | Nomination and Remuneration Advisory Committee(◎ indicates chairperson) | Major knowledge, experience, and capabilities | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Corporate management and business strategy | Finance and accounting | Legal and compliance | R&D, process development and quality | Sales and marketing | Global | Sustainability | |||||||||||||||||||||||

| Motoharu Matsumoto | Chairman of the Board (representative director) |

Male | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||

| Akira Kishimoto | President (representative director) |

Male | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||

| Mamoru Morii | Director | Male | ● | ● | ● | ● | ● | ● | |||||||||||||||||||||

| Reiko Urade | Director | ● | Female | ● | ● | ● | |||||||||||||||||||||||

| Hiroyuki Ito | Director | ● | Male | ● | ● | ● | |||||||||||||||||||||||

| Yoshio Ito | Director | ● | Male | ◎ | ● | ● | ● | ● | |||||||||||||||||||||

| Nahomi Aoto | Director | ● | Female | ● | ● | ● | |||||||||||||||||||||||

| Yoshihisa Hayashi | Full-time Corporate Auditor | Male | ● | ● | |||||||||||||||||||||||||

| Toshiharu Narita | Full-time Corporate Auditor | Male | ● | ● | |||||||||||||||||||||||||

| Yukihiro Yagura | Corporate Auditor | ● | Male | ● | ● | ||||||||||||||||||||||||

| Hiroji Indoh | Corporate Auditor | ● | Male | ● | |||||||||||||||||||||||||

Training for Directors and Corporate Auditors

During Compliance Awareness Month, which is held in October of every year, we invite outside instructors to come and give lectures on compliance to our inside directors, full-time corporate auditors, and other executives. We also hold director training seminars every year, which provide our directors with a deeper understanding of current business conditions, including those surrounding corporate governance.

Our corporate auditors participate in seminars and information exchanges with outside organizations, through which they deepen their auditing-related expertise. For our outside directors and outside corporate auditors, prior to assuming office, we provide them with explanations about our current corporate situation and systems. After they have assumed office, we provide them with opportunities to conduct interviews with directors and executive officers.

Analysis and Evaluation of the Effectiveness of the Board of Directors

All directors and corporate auditors participate in an annual questionnaire concerning the effectiveness of the Board of Directors. The questionnaire focuses on (1) the Board of Directors in general, (2) the running of Board of Directors meetings, and (3) outside directors.

Fiscal 2023 Questionnaire Questions, Opinions, and Action Taken

-

On the topic of “appropriateness of the content and timing of the distribution of materials in advance of the Board of Directors meetings,” a comment expressed that informational materials were sometimes distributed at the last minute prior to a Board of Directors meeting, causing members to attend without adequate understanding of the issues. Our response will be to be more diligent about the timing that materials are distributed so members can be fully informed before attending the meetings.

-

On the topic of “company efforts to provide outside directors with opportunities to visit plants in Japan and overseas and exchange opinions with local executives,” a comment stated that, although the COVID-19 pandemic was one of the reasons, the respondent did not have any opportunities to visit a plant. Our response in fiscal 2024 was to provide outside directors with tours of overseas subsidiary companies.

Fiscal 2024 Questionnaire Opinions

A comment on the composition of the Board of Directors commended the Company for having a majority of outside directors on the Board but recommended establishing a system to ensure sufficient discussion.

Another comment requested that outside directors be provided with opportunities to visit plants in Japan and overseas and engage in discussions with executives so they can gain a full understanding of the situation at the sites. Based on the results of the questionnaire, we have determined that the Board of Directors is viable and that its effective functioning has been ensured. We will continue our efforts to enhance discussions at Board of Directors meetings by using the questionnaire results as a basis for making improvements and evaluating its effectiveness.

Policy on Deciding Directors’ and Corporate Auditors’ Remuneration

Our executive compensation for directors (excluding outside directors) comprises a monthly retainer, performance-linked bonuses, and grants of restricted shares. For outside directors and corporate auditors, remuneration is limited to a monthly retainer.

The total monthly remuneration and bonuses for directors is within the scope determined by the General Meeting of Shareholders, and the total amount of the bonus payment is determined at the General Meeting of Shareholders after deliberation by the Nomination and Remuneration Advisory Committee subject to the approval of the Board of Directors. The amounts of the monthly retainer and bonus for each individual directors are commensurate with those of other companies and are aligned with our business performance (in the case of inside directors only), the economic environment, and objective market research data on remuneration provided by outside specialized agencies. Bonuses are determined using consolidated operating income as an indicator and in consideration of economic conditions, business conditions, status of executed measures, and individual evaluations.

Specific content of monthly remuneration and bonuses are deliberated on and decided by the Nomination and Remuneration Advisory Committee, which is chaired by an outside director and the majority of whose members are outside directors. Unless an equal number of Committee members differ in opinion, the decisions of the Committee are deemed to have been adopted by the Board of Directors.

Grants of restricted shares are determined by the Board of Directors after consideration of individual duties and responsibilities as well as the share price after deliberation by the Nomination and Remuneration Advisory Committee and are within the scope of the total amount determined by the General Meeting of Shareholders. The ratio of the monthly retainer, which is a fixed amount of remuneration, to the bonus and grants of restricted shares, which are variable amounts of remuneration, is generally 6:4 (fixed: variable) on a periodic payment basis.

Remuneration for corporate auditors is determined after consultation with the auditors within the scope of the total amount determined by the General Meeting of Shareholders after reference to what is offered by other companies as determined by surveys conducted by external specialized agencies.

| Category | Total amount of remuneration (million yen) |

Total amount for each type of remuneration (million yen) | Number of eligible officers | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fixed remuneration | Performance-linked remuneration | Non-monetary remuneration | ||||||||||||||||||||||||

| Directors (Number of outside directors) | 338 (37) |

242 (37) |

60 (-) |

35 (-) |

9 (4) |

|||||||||||||||||||||

| Corporate auditors (Number of outside corporate auditors) | 60 (14) |

60 (14) |

- (-) |

- (-) |

4 (2) |

|||||||||||||||||||||

| Total (Number of outside directors) |

398 (51) |

302 (51) |

60 (-) |

35 (-) |

13 (6) |

|||||||||||||||||||||

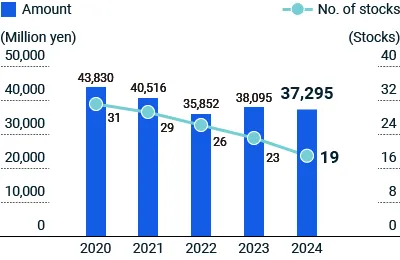

Cross-shareholdings Policy

NEG does not hold cross-shareholdings except in cases where it recognizes the rationale for cross-shareholdings, such as business alliances and maintaining/enhancing business partnerships.

In addition, after taking into account factors such as changes in the business environment, we will verify the appropriateness of holdings from a quantitative perspective based on cost of capital and from a qualitative perspective based on management strategy and other considerations before we proceed with further reductions.

NEG exercises the voting rights relating to the cross-shareholdings after comprehensively considering issues including whether or not the proposal effectively complies with the company’s shareholding policy and whether or not it would be expected to increase the corporate value of the issuing company.