Medium-Term Business Plan

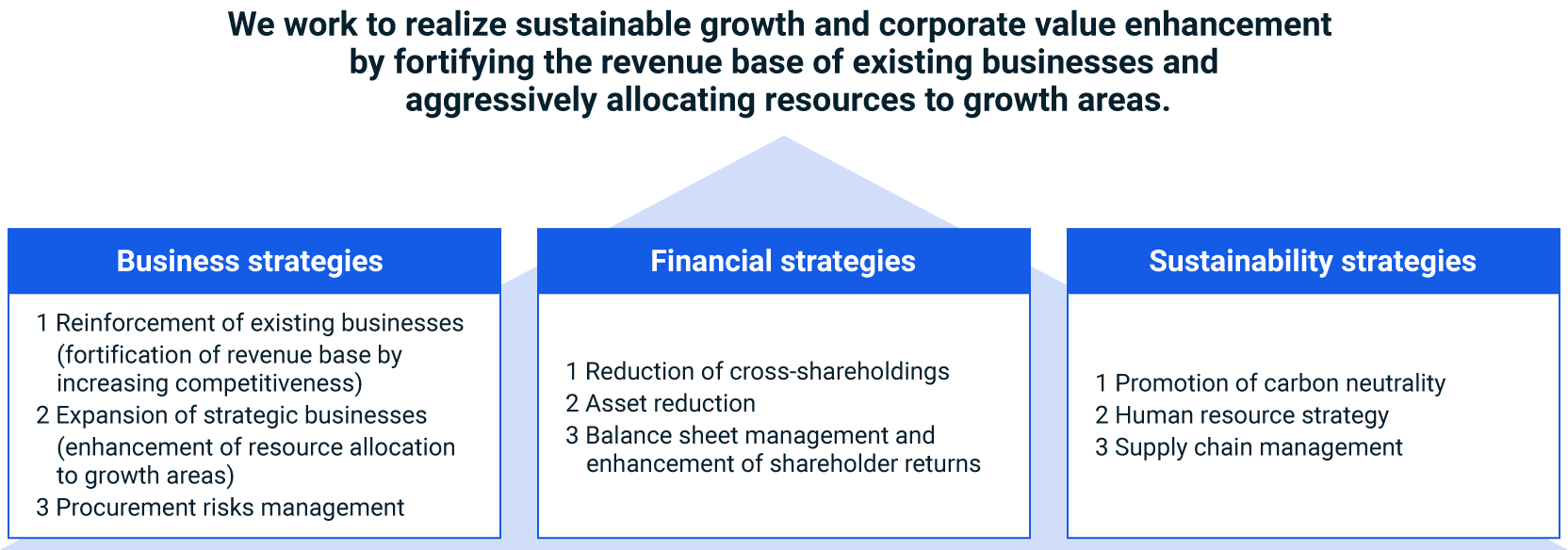

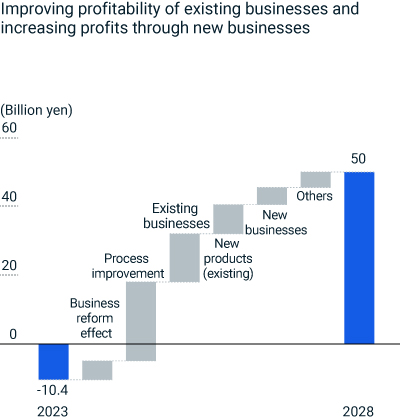

In February 2024, we announced our new Medium-Term Business Plan, targeting the fiscal year ending in 2028. This plan focuses on strengthening the revenue base of our existing businesses while making strategic investments in growth areas, with the ultimate goal of driving sustainable growth and enhancing corporate value.

Basic Policy and Objectives

Our basic policy is to strengthen the revenue base of our current businesses while actively investing in future growth opportunities. The aim is to foster long-term growth and enhance corporate value through three key strategies: Business Strategy, Financial Strategy, and Sustainability Strategy.

"STRONG GROWTH"

Management Targets

Positioning

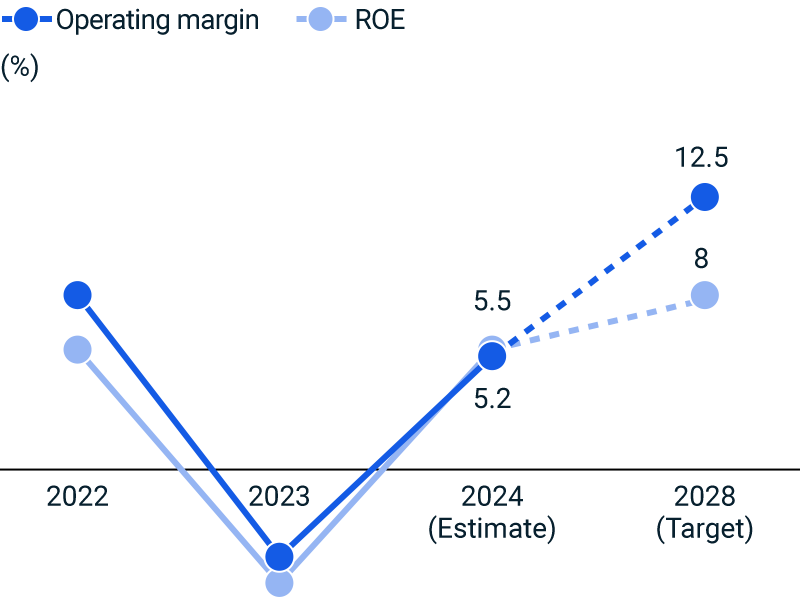

Since the launch of the EGP2026 plan in 2022, major shifts have occurred across key sectors, including displays, medical care, automotive, and energy. To address these evolving market conditions, we introduced a new Medium-Term Business Plan, EGP2028, in February 2024, focused on achieving sustainable growth and enhanced corporate value.

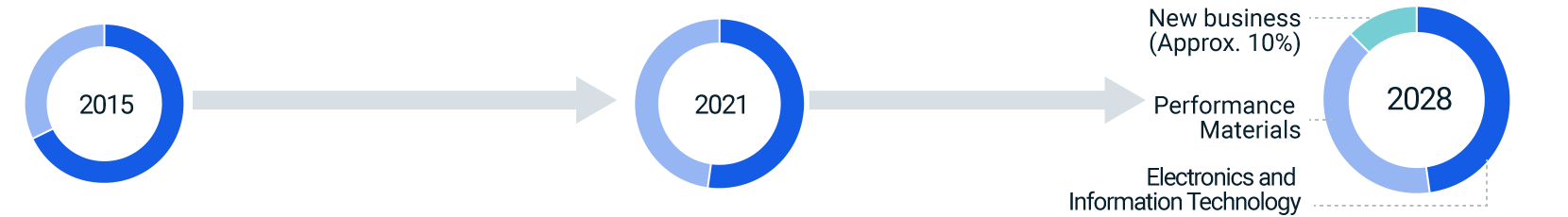

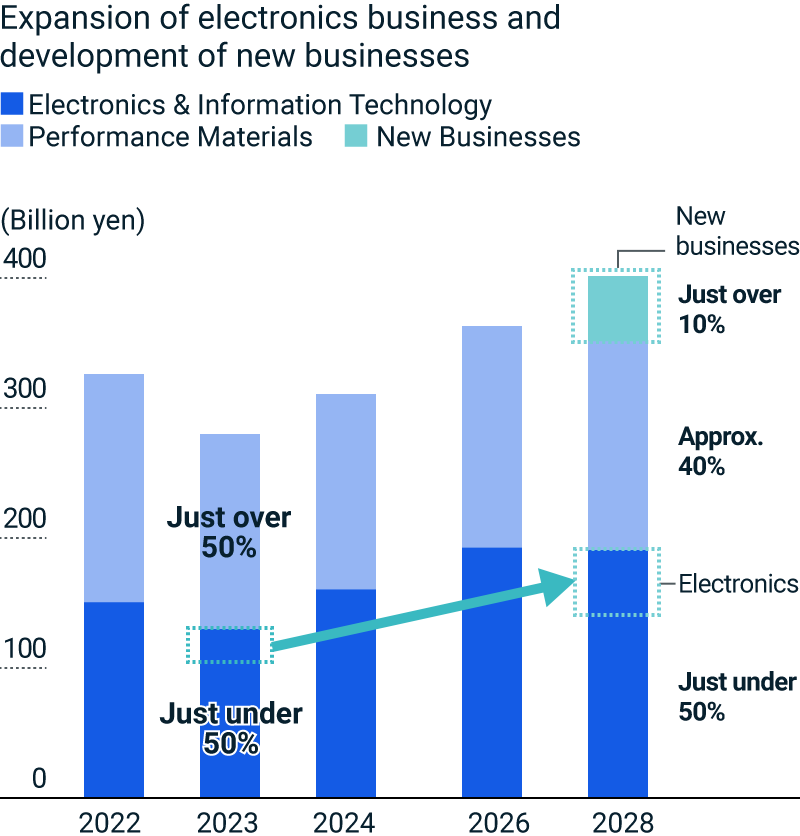

Performance Image of EGP2028

Creation of Market and Social Value

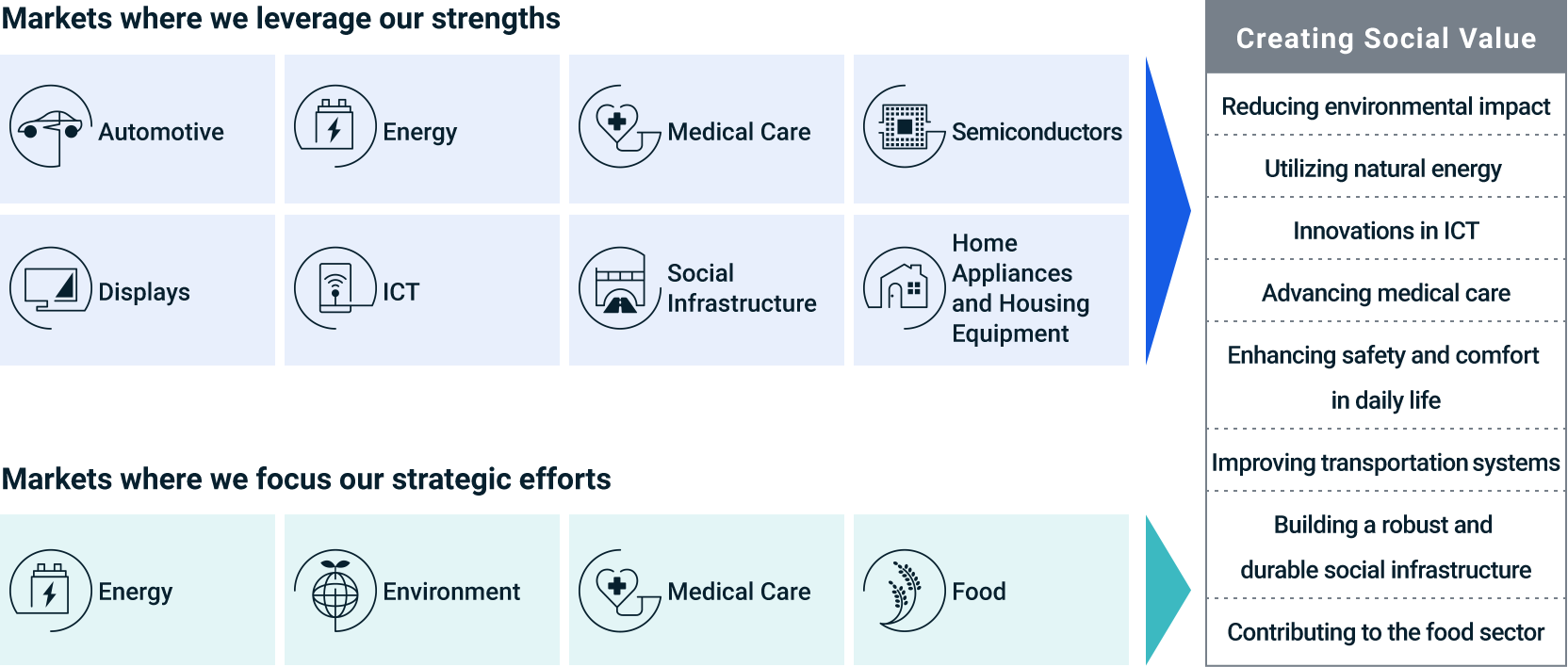

We have identified eight priority markets where leveraging our core strengths will have the greatest impact: Automotive, Energy, Medical Care, Semiconductors, Displays, ICT, Social Infrastructure, and Home Appliances & Housing Equipment. Moving forward, our strategic focus will additionally target four key markets: Energy, Environment, Healthcare, and Food.

Business Strategy

Reinforcement of Existing Businesses

―Strengthen the Earnings Base by Improving Competitiveness

-

Develop high value-added products and strengthen commercialization.

-

Leverage all-electric melting technology to increase productivity and quality.

-

Build a strong business foundation.

(efficient operation of resources, utilization of digital transformation, review of procurement, operational/manufacturing process reform, etc.) -

Thoroughly analyze business profitability to determine whether to invest in, downsize, or withdraw from businesses.

Automotive

Energy

Medical Care

Semiconductors

Displays

ICT

Social

Infrastructure

Home

Appliances

and Housing

Equipment

Expansion of Strategic Businesses―Expanding Resources to Growth Fields

-

Leverage our strengths in special glass and allocate resources aggressively to business with promising growth opportunities to expand strategic businesses.

-

Expand device businesses that will increase the added value of glass products.

-

Bolster research and development resources focusing mainly on the fields of energy, medical care, environment, and food, and collaborate with universities, research institutes, venture companies, etc.

-

Establish a budget for strategic investment (50 billion yen in 5 years) and actively undertake M&A, strategic alliances, business investments, etc.

Energy

Environment

Medical Care

Food

Financial Strategy

Reduction of Cross-Shareholdings

In consideration of changes in the business environment, we will evaluate the appropriateness of shareholdings both quantitatively based on cost of capital and qualitatively based on management strategies to further cross-shareholdings and their proportion in consolidated net assets.

Asset Reduction

We will dispose of any non-core assets arising in the course of EGP2028, structural reform of businesses, etc., as appropriate in order to increase asset efficiency.

Balance Sheet Management: Prioritizing Capital Efficiency

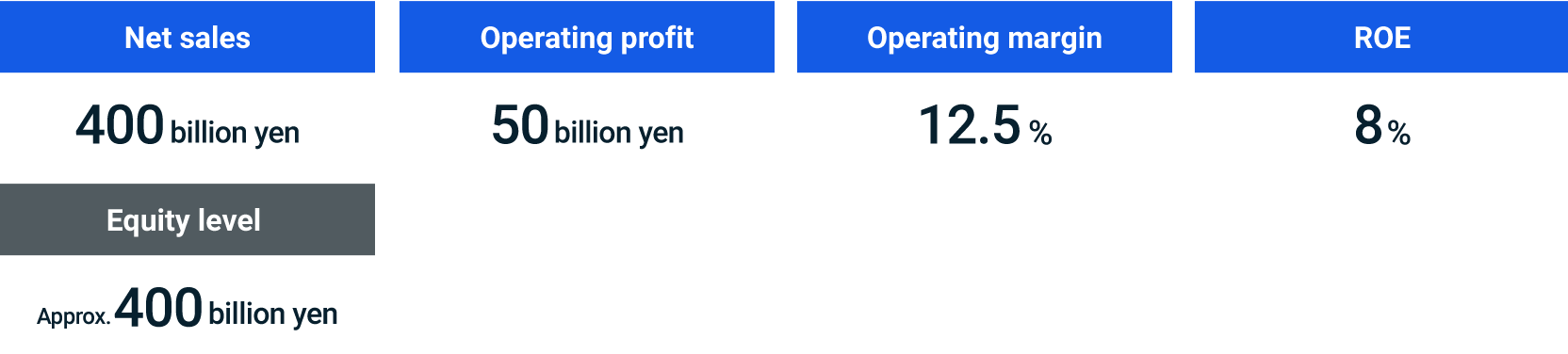

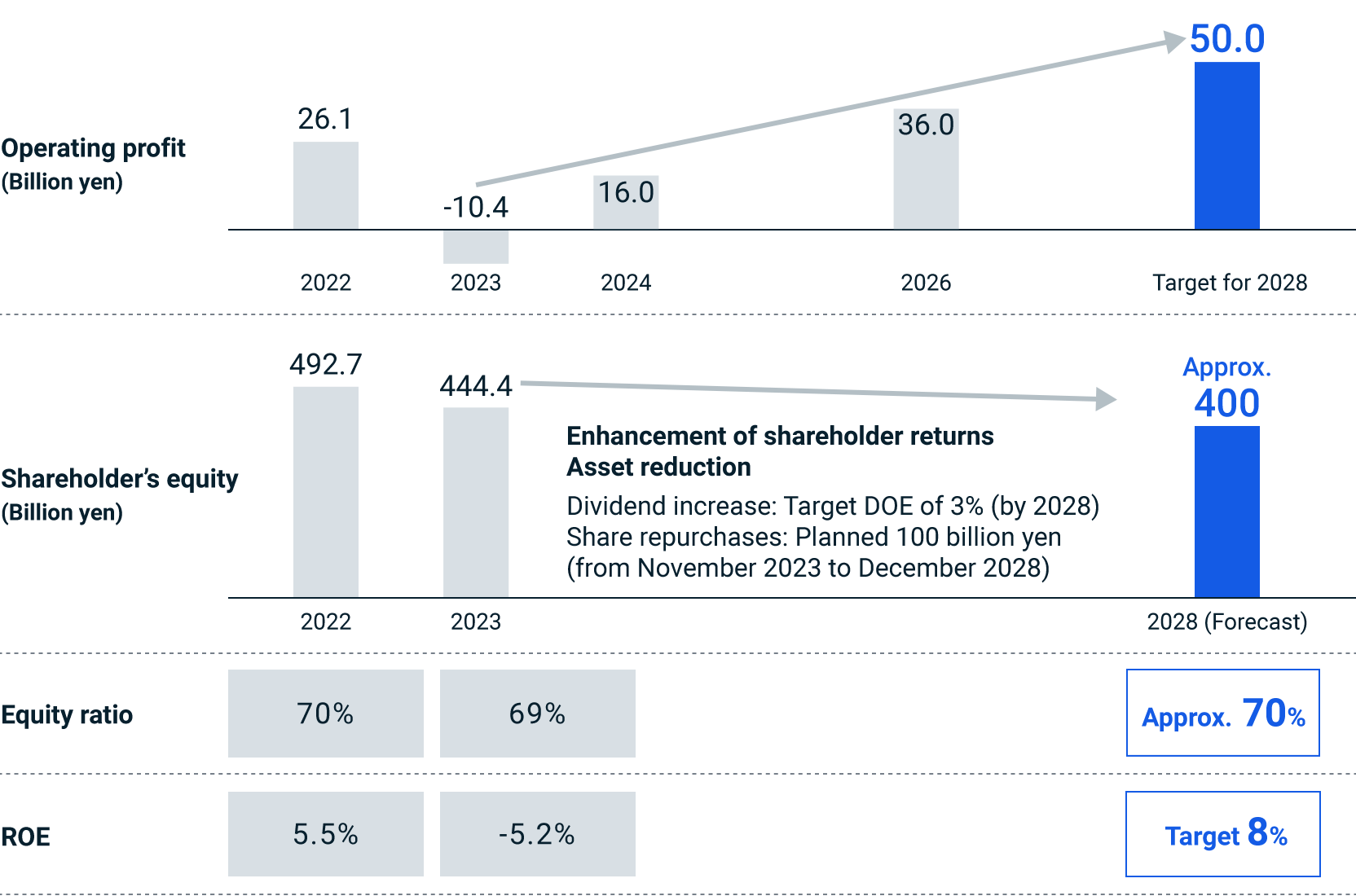

We are committed to enhancing shareholder returns through higher dividends and share buybacks, while also optimizing assets. Our goal is to reduce shareholder equity to around 400 billion yen by the fiscal year ending in 2028. This will allow us to maintain an equity ratio of roughly 70% and increase our return on equity (ROE) to 8%.

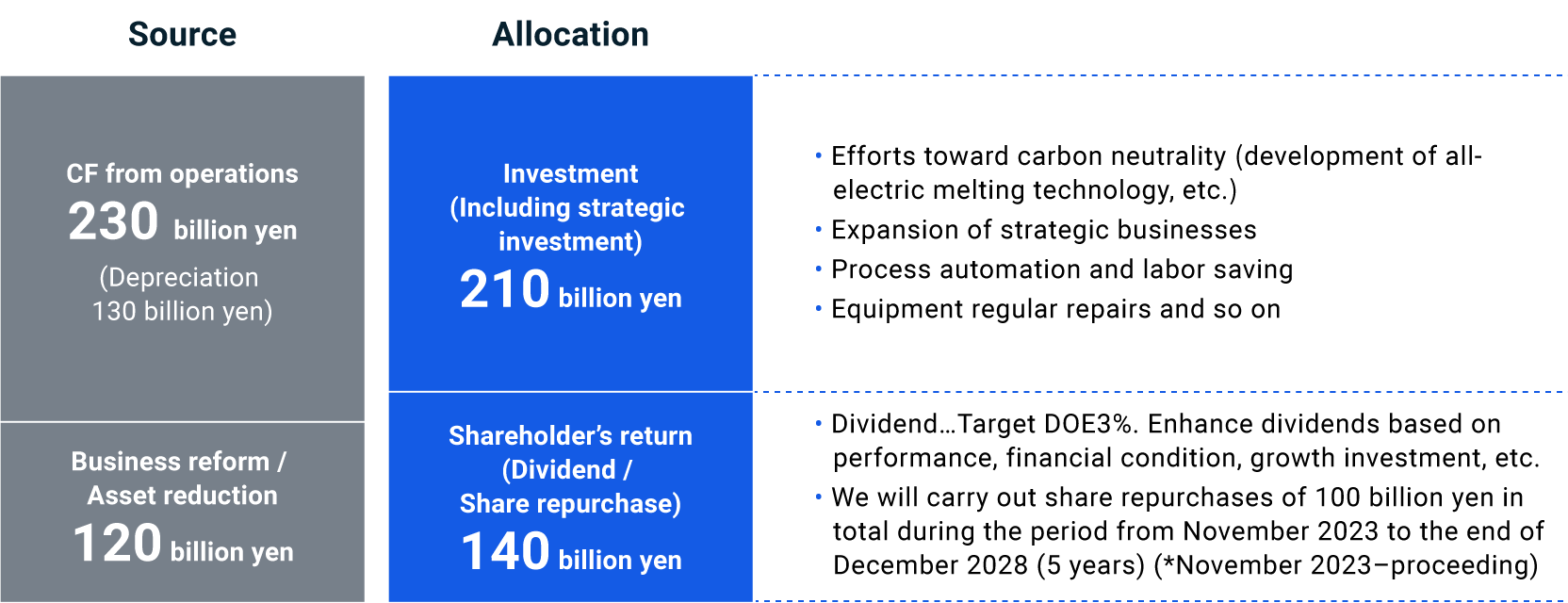

Cash Allocation

To maximize corporate value, we are balancing growth investments with shareholder returns. We plan to allocate 230 billion yen for investments, including strategic investments, sourced from 120 billion yen in operating cash flow and 210 billion yen from business reforms and asset reductions. Additionally, we will allocate 140 billion yen for dividends and share buybacks.

Sustainability Strategy

Promotion of Carbon Neutrality

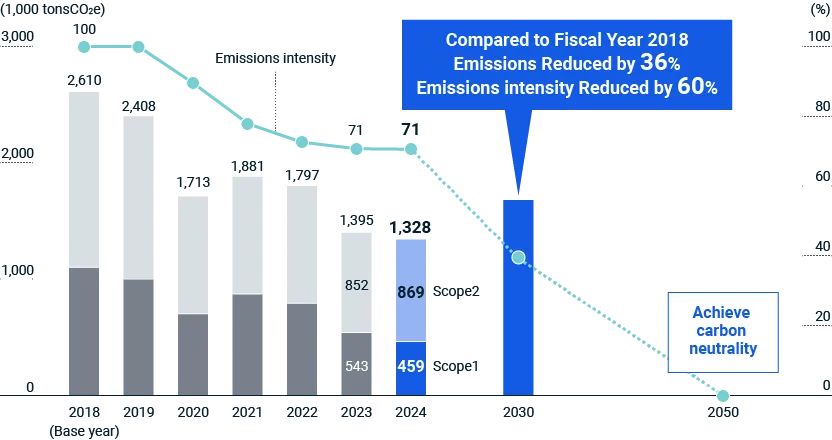

We are committed to advancing all-electric melting technology and other innovations that address climate change while achieving sustainable growth and enhancing corporate value. Our sustainability efforts will concentrate on three key areas: electrifying all production processes, investing in and procuring renewable energy, and developing CO₂-free technologies like hydrogen energy.

-

Manufacturing process: Promoting all-electric melting, improving melting, efficiency, electrification for facilities and operations automation and optimization

-

Utility facilities: Facility optimization and operation optimization

-

Technological development: Development for CO2-free energy (such as hydrogen)

-

Procurement: Investment and procurement for renewable energy

CO2 Emissions Reduction Targets

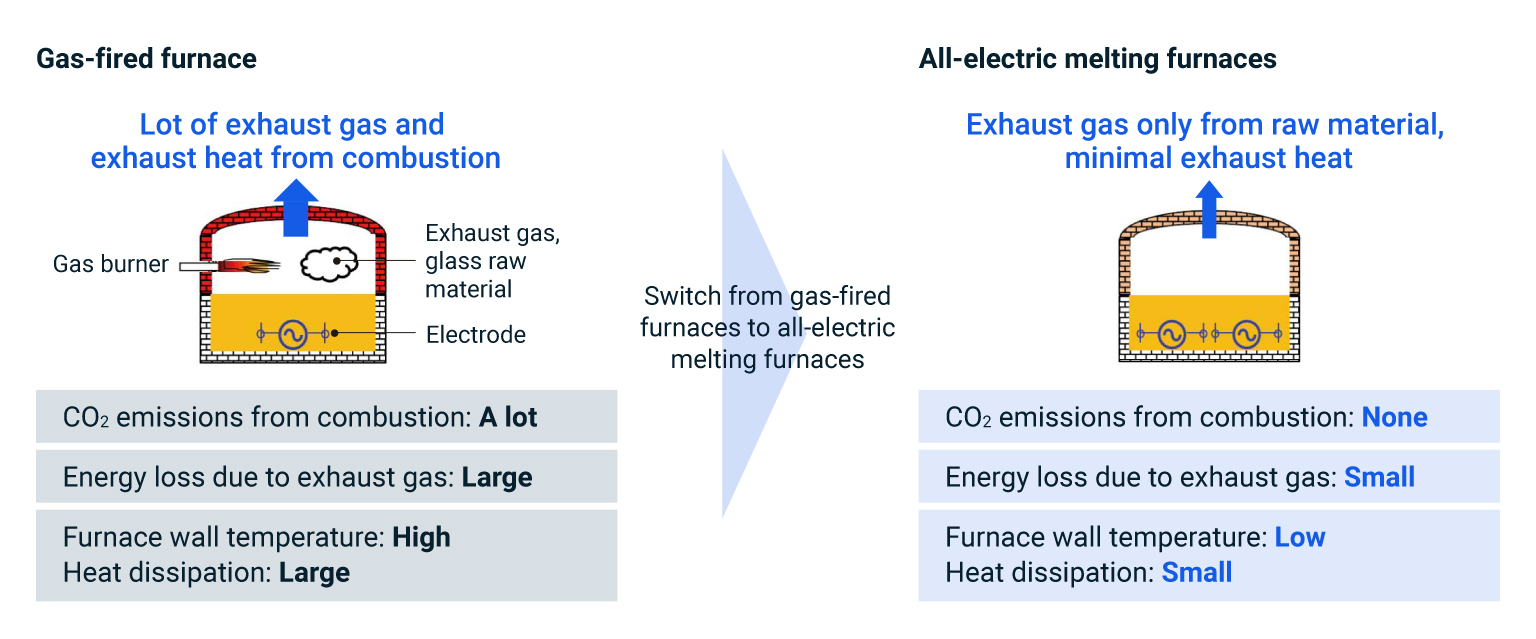

In Focus: Shift to All-Electric Melting Furnaces

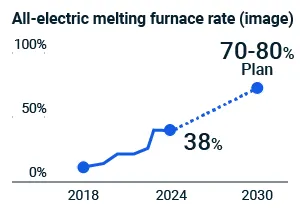

All-electric melting furnaces offer significant benefits, including eliminating CO₂ emissions from combustion, removing energy loss from exhaust gasses by directly heating melted glass, and lowering furnace wall temperatures. By fiscal 2023, the adoption rate for these furnaces increased to 36%, and we aim to raise it to 70–80% by fiscal 2030. This transition from gas-fired furnaces to all-electric furnaces will improve both productivity and quality as we strive toward carbon neutrality.

Human Resource Strategy

We are significantly investing in our workforce to create a dynamic environment where diverse talent can thrive. Our focus will be on three pillars that strengthen our competitive edge:

-

Recruitment and training of personnel with advanced knowledge and skills

-

Promotion of diverse human resources

-

Creation of a comfortable workplace for diverse human resources to feel job satisfaction

Supply Chain Management

We will promote initiatives to fulfill our social responsibility with regard to environment, biodiversity, human rights, etc., throughout the supply chain and work to achieve sustainable growth and corporate value enhancement.